- Campaign Planning Learning Path – Use a data-driven approach to create campaign plans that consistently deliver quality digital marketing results

About the author

Dr. Dave Chaffey

Dave is co-founder of Smart Insights and creator of the Smart Insights RACE planning framework. For his full profile, or to connect on LinkedIn or other social networks, see the About Dave Chaffey profile page on Smart Insights. Dave is author of 5 bestselling books on digital marketing including Digital Marketing Excellence and Digital Marketing: Strategy, Implementation and Practice. In 2004 he was recognized by the Chartered Institute of Marketing as one of 50 marketing ‘gurus’ worldwide who have helped shape the future of marketing.

![]()

Starter or Pro Membership is required

Access this resource now

Starter and Pro members get full access to this and other resources in the Marketing campaign planning Toolkit.

Membership options Already a Starter/Pro member? Login here

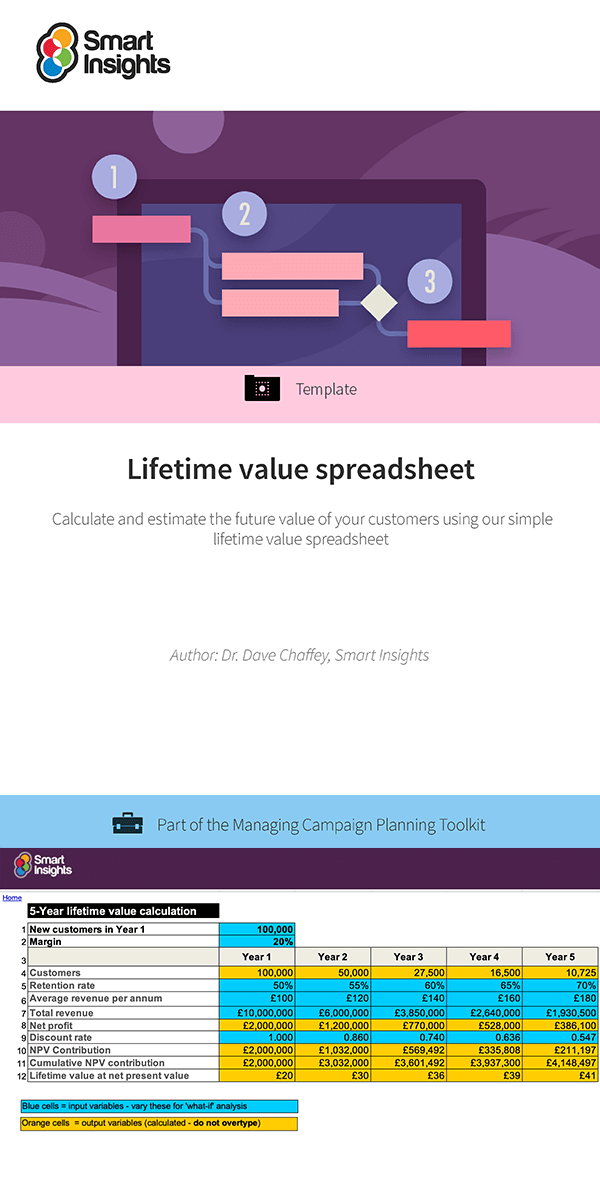

The Lifetime value spreadsheet is included in the

Marketing campaign planning Toolkit

. or take a look at the other Guides and Templates in this Toolkit

![]()

Free membership

Free digital marketing plan template

Part of the Digital marketing strategy and planning Toolkit Learn More![]()

Business membership

Marketing campaign plan template

Part of the Marketing campaign planning Toolkit Learn More![]()

Business membership

Campaign timeline/project plan template and example

Part of the Marketing campaign planning Toolkit Learn More![]()

Business membership

Editorial calendar spreadsheet

Part of the Marketing campaign planning Toolkit Learn More![]()

Business membership

Marketing campaign planning guide

Part of the Marketing campaign planning Toolkit Learn More![]()

Business membership

Product launch playbook

Part of the Marketing campaign planning Toolkit Learn More![]()

Business membership

Event marketing guide

Part of the Marketing campaign planning Toolkit Learn More

Trusted by marketers all over the world

Since 2009 our toolkits have helped thousands of marketers in over 170 countries to hit - and exceed - their targets.

Will you be next?

. plus over 165,000 consultants, agencies, entrepreneurs and SMB's in over 170 countries.

Get better results

"A goldmine of digital information on digital marketing that can help you get better results"

Digital Marketing CoE Leader

Make your job easier

"I'd recommend signing up to Smart Insights for a suite of useful tools

from planning templates to strategy docs and a variety of other guides to make your job easier."

It's my digital marketing go-to Bible Tenfold improvements in digital marketing results."