Home Renovation Budget Template (Excel Download)" width="409" height="195" />

Home Renovation Budget Template (Excel Download)" width="409" height="195" /> Home Renovation Budget Template (Excel Download)" width="409" height="195" />

Home Renovation Budget Template (Excel Download)" width="409" height="195" />

Whether you want to remodel your kitchen, bring your bathroom into the 21st century, or tear down the walls of your entire home, our home renovation cost estimator/budget sheet will work for you.

Actually, we undersold that—

Not only is it free, and not only will it work for you, but it’ll also help you set your budget, map out your project in detail, and help you track your actual costs as you go.

This resource is so good we should probably charge at least a few bucks for it. But for now, it’s completely free for you to use, no strings attached.

This article will show you:Read more:

A renovation budget template is a spreadsheet that helps you plan, track, and manage the costs of a home improvement or remodeling project.

Examples of home construction expenses are things like replacing existing hardware, trim, windows, flooring, and even appliances (if you’re doing a full kitchen remodel).

Your home renovation budget sheet should help you plan out and track:

When you put together a plan with a home renovation budget spreadsheet, you should have a clear picture of what your total project will cost.

Then, as your project gets underway, you should also be able to track your actual expenses and monitor how well you’re doing vs. your budget.

Many people have made a budget for a remodel project. I’d wager that nearly all of them blow their budget by the time their project is over.

How can you guard your money from the same fate and actually keep your build within (or under) budget?

Here are some ideas for you:

You’re reading through this article—and it seems like I know what I’m talking about. But do I really?

What’s my experience with home renovations and budgeting?

First off, budgets are kind of my nerdy passion. I graduated with my Bachelor’s and Master’s in Finance, and I’ve been running Life And My Finances since 2010 until it was acquired by MoneyZine.

Budgets are fun, especially when you nail them. (I told you—super nerd.)

I bought my first house in 2012. It was a foreclosure and needed work. I tore down the dining and entry walls, redid the kitchen flooring, and gave the half-bath a complete remodel.

Since then, I’ve purchased two other foreclosures. Again, both needed work, so I budgeted for the repairs and did a ton of the rehab myself.

I stayed on budget for both projects, even with a few surprise expenses that popped up along the way.

Finally, I’ve worked with spreadsheets and Excel since 2008, when I started my career as an analyst.

Making cool-looking spreadsheets is yet another nerdy passion of mine. They look awesome, work well, and usually get raving reviews from everyone that uses them.

Am I qualified to write this post on home renovation, budgeting, and Excel templates?

Have you ever wondered if your project makes financial sense? It can be tough to know.

As for me, I ask myself two questions:

My wife and I were considering a second-story master suite addition over our garage a few years back.

The initial cost estimate was $75,000.

We asked our realtor how much she thought it would add to our home value—she said about $45,000.

So it added some value, but less than we’d pay for the project.

But like I mentioned above, there’s more than just the pure cost to consider.

With this master suite, my wife and I would have a place of solitude all to our own. Plus, this would free up our current bedroom, which would become a much-needed at-home office.

All-in-all, totally worth the investment.

When you’re asking yourself if your renovation project is a good investment, be sure to consider the financial implication—but don’t forget to ask yourself about the years of joy you’ll get from that project as well.

You may be pretty good with numbers—and you may have a great mind for project planning and leading.

So do you really need a renovation budget tracker?

Yes. Everyone does.

By using a remodel plan template, you’ll have a list of all the micro-projects right in front of you while figuring out your project scope and budget.

With a list of items, you will be much less likely to forget something. And no matter how good you are, I’m sure you forget something occasionally.

Thanks to a rehab template, you’re essentially putting a project plan together. If there are any deviations to the plan, you can quickly review the spreadsheet and tweak it where needed to get yourself back on budget.

Finally, your renovation template isn’t just for you. It’s for your contractors too.

Let them know when your plans and expectations are, and they can help you meet those goals—perhaps with suggestions that you never would have thought of yourself.

Alright. You’re ready.

You’ve considered the project, you know you want to move forward, and you understand the need for a renovation budget worksheet.

What should be your first steps? What do you do before you start budgeting?

One of the first things you should do is get a number in your head for what you want to spend.

If you don’t do this before the project, you’ll almost certainly spend far more than what’s needed.

What is this project worth to you? Would it be worth spending $5,000? $20,000? More?

If the quotes come in far higher than that, then it’s a clear signal that you shouldn’t do it and move on with your life.

I’m a pretty hardcore anti-debt guy—so if I’m doing an improvement project on my house that isn’t a need, then I’m going to do it with cash.

You might think differently.

You might be okay with a loan if the project adds a great amount of value to your home and if you can easily afford the payments.

That’s fine, but be sure to understand the risks:

If you can do the renovation without the loan and still keep some money in the bank for an emergency fund, that’s preferred.

So when it comes to getting a number in your head for your project, I’d suggest you look at your bank account, not the size of loan you qualify for.

Once you have a number in your head for the project, it’s time to get some quotes on what it’s actually going to cost.

Contact at least three contractors and get their estimates. Are these numbers fitting into your predetermined total budget?

If you’ve never done a remodel before, you really don’t know what permits you need and what they’ll cost you.

Check online or head into your local city or township office.

Let them know what your project scope is, and they’ll help you understand what permits are needed and what the costs are for each of them.

How long would you like this renovation project to last?

Based on what you’re hearing from your contractors on when they can start and how long it’ll take them, start mapping out the project timeline.

This will help get you prepared, and it’ll also help you better understand what’s needed for your budget template (with items like insurance, dumpster rentals, port-a-johns, and permits).

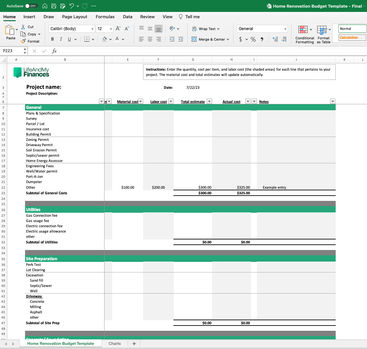

Finally, it’s time to put your home renovation budget together.

To make one, you’ll need to list out every detail of your project into rows and then add columns for:

Quantity of materials needed. Material cost per item. Total material costs. Labor costs. Total estimated costs. Total actual costs (to see how well you’re doing vs. your budget).Sound overwhelming? Don’t worry about it—we’re supplying all of this to you for free with our home renovation budget template Excel download

To keep track of your renovation costs, you simply add your daily spending into your renovation budget tracker.

Every dollar that gets spent needs to be added into your budget spreadsheet and constantly compared to what your budget was for each line item.

If you’re over in one category, you should be looking for another category where you can save. (Either that or become okay with going over budget.)

So how do you do this? How do you actually know what each line item of your budget should be?

Honestly, it’s super tough to do this from scratch.

It’s best to start with a free home improvement budget template (like the one we’re providing in this post) and then tweak it to fit your needs.

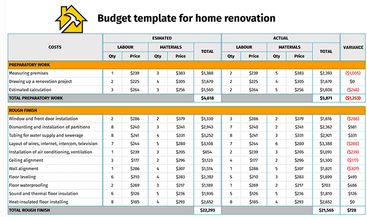

Want to see some examples of renovation budgets?

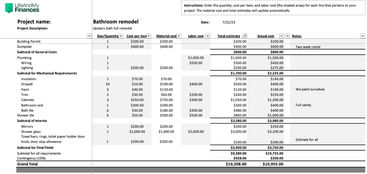

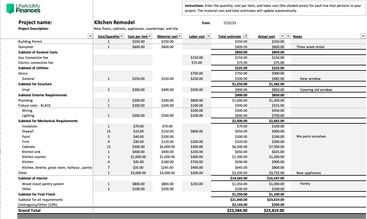

The most popular home renovation projects are the bathroom remodel, and a kitchen renovation.

Interested in seeing our template in action? Check out the budget snapshot of each below:

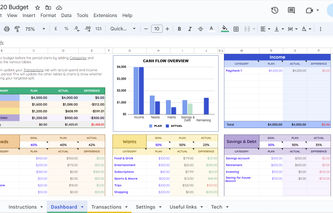

You like the remodel budget sheet, you want to use it—and you’d like to know more about how to navigate it.

It’s actually pretty easy.

Here are the bulleted how-to instructions:

This sheet can be used for a full house remodel or a small closet update. It’s versatile, yet super simple.

The download links have been included throughout this post.

But—just in case you missed them—the below sections will help you download the renovation budget spreadsheet based on your needs (Excel, Google Sheets, or a simple printout).

If you have Excel and prefer to use it for your home renovation budget template, this download link

is best for you.

Just open the file and start using it. It’s as simple as that.

If you don’t have Excel and would rather download your renovation budget template for Google Sheets, we created a version for that.

, then click “Get copy,” and the file will download to your Google Drive.

If you don’t want to keep track of your project on your computer and you’d instead like to have a free printable home renovation template, we created a version for that too.

for the printable Excel template download.

for the printable Google Sheets template. (When it opens, click “Make a copy,” and it will save to your Google Drive.)

Once you’ve got them open, click “File” then “Print” to print out your sheets and map out your project budget.

Don’t like our spreadsheet? We’re a little hurt—but we get that we can’t please everyone.

Below are the other top free renovation budgets that we’ve discovered. (Honestly, though, they all pale in comparison to what we’ve put together.)

Monday.com is a well-known project management software company.

If you want to use their software for your project, you’ll need to sign up and create a login for their site.

But if you just want an Excel spreadsheet download, they do offer that

The spreadsheet is a decent resource, but it doesn’t provide you with any suggested rows for your renovation.

It’s a clean slate, and you’ll need to fill everything in.

This site provides a free Google Sheets template for your renovation project budget.

It’s fairly basic, but it does provide an initial framework for your project. You can download the GooDocs template here

When you click the “Edit template” button on the right side of the page, it’ll ask you to “Get copy” to open the Google doc on your drive.

Once you do that, you’ll have immediate access to their home renovation spreadsheet.

Home renovation projects will never go exactly as planned. There will be unexpected twists and turns, and with those come unexpected expenses.

A good rule of thumb is to plan a 10% contingency into your project budget. If you think a project will cost $10,000, then plan an extra $1,000 for the unknowns.

It’s similar to how you’d have an emergency fund in your own personal budget worksheet. Something unexpected always hits the budget, so you’ve got to plan for it.

If your renovation project is a need, then you may need to take out a loan to complete the project and prevent further damage to your house.

If, however, your remodel project is to add a second-story master bedroom suite over the garage and is going to cost you $200,000, then I would not recommend taking out a loan to do it.

Instead, save up the cash and keep your remodel within your means.

It’s rarely smart to take out a 401k loan. When you take out a 401k loan, you’re forgoing any potential gains in the market during that time.

Also, if you leave your job, you’re required to pay back your loan in full within 60 days of your leave. If you can’t do that, it’s considered an early withdrawal, so you’ll be taxed and penalized.

When considering a renovation project, it’s best to either pay cash or take out a standard installment loan through the bank.

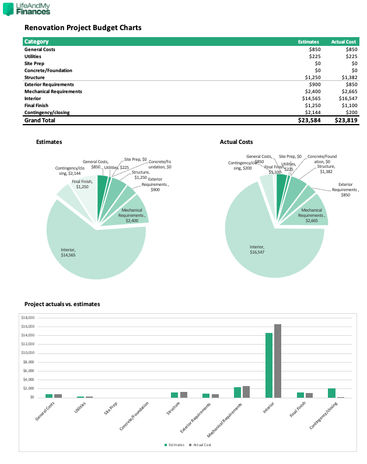

The best free kitchen and bathroom remodel budget template is the one we offer in this post.

It’s detailed, it’s clean, and it even offers helpful charts so you can visually see if you’re staying on budget.

If you’re remodeling a small bathroom, $50,000 is certainly enough for a remodel. If you’re renovating a kitchen, you should still be able to do it for under $50,000.

If you’re remodeling an entire house, then $50k won’t be enough. If you have $50,000, you can likely update two or three rooms with a modest styling.

First, you need to define the high-level scope of the project (for example, kitchen remodel).

Next, consider the details that need to be updated (flooring, walls, cabinets, tile, appliances, lighting, and the like).

Estimate each detailed material cost and labor cost. Then add 10% for unknown expenses. The total result is your remodel project cost estimate.

Budgeting while ensuring you don't compromise on quality can seem daunting. Whether filling your pantry, updating your wardrobe, or keeping up with the latest tech, smart shopping strategies are crucial for keeping your finances in check.

April 2nd, 2024.jpg)

The loud budgeting trend went viral recently on TikTok, and after several years of rising costs and high inflation rates, thousands of social media users are flocking to the trend to embrace the concept of being vocal about your budgeting goals.

March 20th, 2024

Do you ever run out of money before the end of the month? Or stare in disbelief at your dwindling balance and wonder where it’s all gone?

February 26th, 2024

If you’re anything like me, your diet probably went out of the window over the holidays, with so much tasty but unhealthy food around.

February 12th, 2024

Valentine’s Day can be a fun opportunity to show your partner how much you love them - but it can also be a day that comes with a lot of pressure and external expectation to spend money and make extravagant gestures.

February 6th, 2024 Welcome to MoneyzineFor two decades we've been sharing impartial, expert content with our global audience. Find out more about us

As seen in Top Budgeting Guides Top Personal Finance Guides Budget Tools & Calculators Most Popular Guides Explore Moneyzine

Derek has a Bachelor's degree in Finance and a Master's in Business. As a finance manager in the corporate world, he regularly identified and solved problems at the C-suite level. Today, Derek isn't interested in helping big companies. Instead, he's helping individuals win financially — one email, one article, one person at a time.

Derek has a Bachelor's degree in Finance and a Master's in Business. As a finance manager in the corporate world, he regularly identified and solved problems at the C-suite level. Today, Derek isn't interested in helping big companies. Instead, he's helping individuals win financially — one email, one article, one person at a time.

Lauren is a published content writer and journalist. In the last five years, she has written about a range of subjects, including business, technology, and finance. She was born in June 1994 in the UK, but relocated to Barcelona five years ago. Initially covering topics like business and technology, Lauren is now dedicated to her position as a personal finance journalist and is always keen to keep learning and evolve as a finance writer.

Lauren is a published content writer and journalist. In the last five years, she has written about a range of subjects, including business, technology, and finance. She was born in June 1994 in the UK, but relocated to Barcelona five years ago. Initially covering topics like business and technology, Lauren is now dedicated to her position as a personal finance journalist and is always keen to keep learning and evolve as a finance writer.

Moneyzine is your trusted partner in financial empowerment. With our comprehensive guides, user-friendly calculators, and expert tips, we're dedicated to helping you navigate and shape your financial future.

Please be aware that some of the links on this site will direct you to the websites of third parties, some of whom are marketing affiliates and/or business partners of this site and/or its owners, operators and affiliates. We may receive financial compensation from these third parties. Notwithstanding any such relationship, no responsibility is accepted for the conduct of any third party nor the content or functionality of their websites or applications. A hyperlink to or positive reference to or review of a broker or exchange should not be understood to be an endorsement of that broker or exchange’s products or services. Risk Warning: Investing in digital currencies, stocks, shares and other securities, commodities, currencies and other derivative investment products (e.g. contracts for difference (“CFDs”) is speculative and carries a high level of risk. Each investment is unique and involves unique risks. CFDs and other derivatives are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how an investment works and whether you can afford to take the high risk of losing your money. Cryptocurrencies can fluctuate widely in prices and are, therefore, not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework. Past performance does not guarantee future results. Any trading history presented is less than 5 years old unless otherwise stated and may not suffice as a basis for investment decisions. Your capital is at risk. When trading in stocks your capital is at risk. Past performance is not an indication of future results. Trading history presented is less than 5 years old unless otherwise stated and may not suffice as a basis for investment decisions. Prices may go down as well as up, prices can fluctuate widely, you may be exposed to currency exchange rate fluctuations and you may lose all of or more than the amount you invest. Investing is not suitable for everyone; ensure that you have fully understood the risks and legalities involved. If you are unsure, seek independent financial, legal, tax and/or accounting advice. This website does not provide investment, financial, legal, tax or accounting advice. Some links are affiliate links. For more information please read our full risk warning and disclaimer.